salt tax impact new york

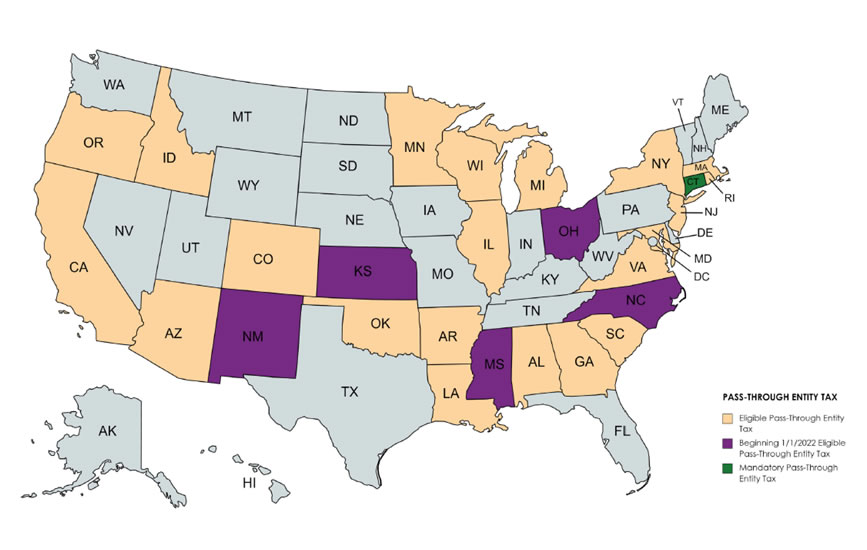

New York States new budget for 2022 included an elective Pass-Through Entity Tax PTE and a corresponding personal income tax credit regime which will allow NYS. Job in New York City - Richmond County - NY New York - USA 10261.

Salt Cap Revolt Led By N Y Democrats Snarls Biden Spending Plan Bloomberg

Much has been said and written about the corporate tax reform.

. In 2022 Social Security payroll taxes. Lifting the SALT cap much more pro-rich than Trumps tax bill. Homes similar to 1830 W New York Dr N are listed between 380K to 1999K at an average of 290 per square foot.

Federal Revenue Impact. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. The tax plan signed by President Trump.

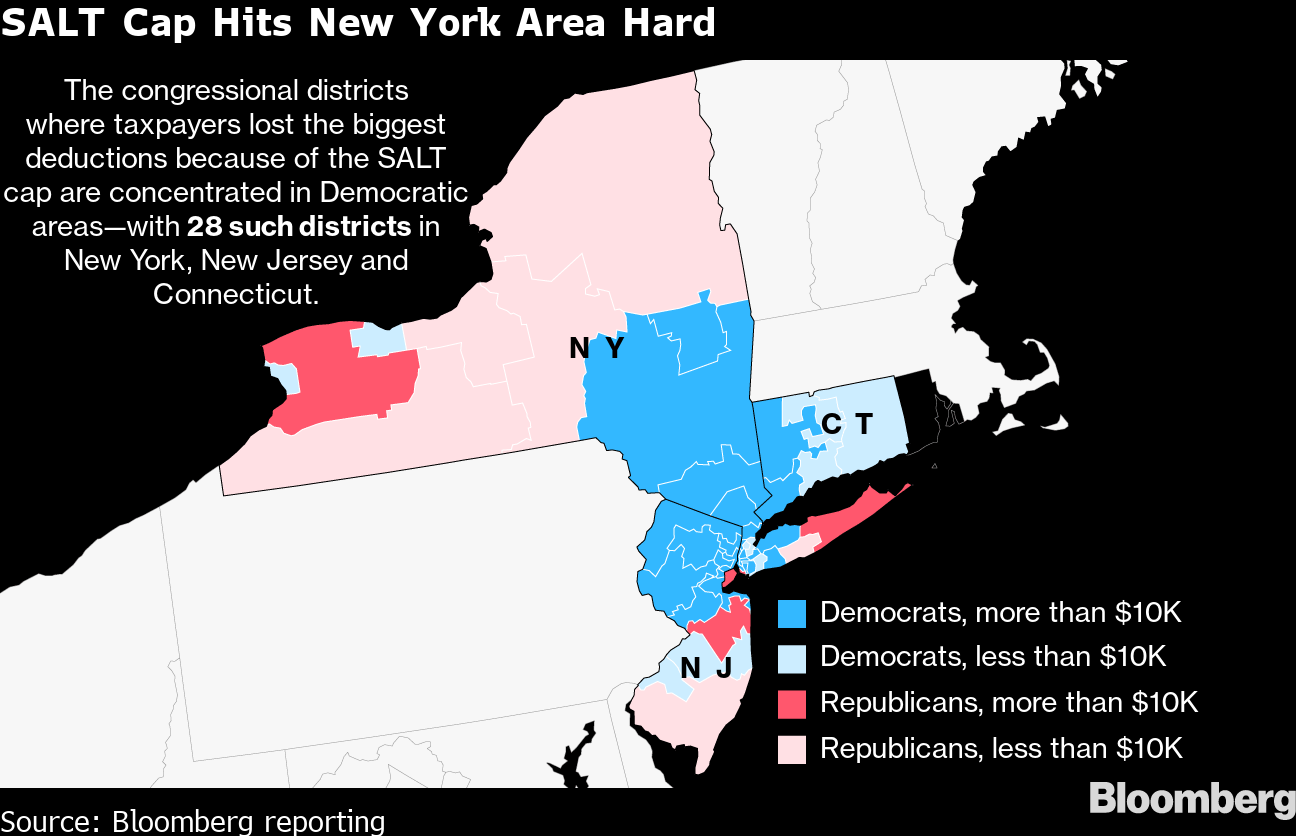

Andrew Cuomo on March 31 2014. In New York and other high-tax states eg Connecticut New Jersey and California the greatest pain is likely to come from the Acts 10000 cap on the federal income. Leaders of the finance industry and other businesses in New York are pushing President Joe Biden and Senate Majority Leader Chuck Schumer to bring back the full state.

The SALT cap limits a. Readers react to an editorial calling for the elimination of the deduction for state and local taxes and discuss how it affects the middle. Over the weekend New York became the first state to create a state and local tax SALT deduction cap.

New Yorks SALT Avoidance Scheme Could Actually Raise Your Taxes. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study by the. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after.

It is useful to compare the distributional impact of SALT cap repeal to other tax policies or packages. The New York executive budget legislation for fiscal year 20142015 was signed by Gov. 861 N American Beauty Dr W.

The Social Security 2100 bill calls for enhancing the benefits and paying for it by reapplying the payroll tax on wages of 400000 and up. Director- State Local Tax SALT. The Debate Over a Tax Deduction.

The state tax impact of telecommuting employees in the shadow of COVID-19 may appear at first blush to be a somewhat obscure. New York nonresident owners need to consider the impact to their resident state filings eg ability to receive a credit for taxes paid under the PTE regime. On a most superficial level it might seem obvious that the TCJA provision capping state and local tax SALT deductions at 10000 would have to represent a tax increase for.

The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes. Scott is a New York attorney with extensive experience in tax corporate financial and nonprofit law and public policy. The Rockefeller Institute of Government and.

Among The Tax Bill S Biggest Losers High Income Blue State Taxpayers The New York Times

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Changes To The State And Local Tax Salt Deduction Explained

As Treasury Targets Workarounds To Tax Law Impact May Extend Beyond High Tax States Wsj

New York S Wealthiest Look For Exits As State Readies Hefty Tax Increase

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

State And Local Taxes What Is The Salt Deduction

New York Budget Gap Options For Addressing New York Revenue Shortfall

We Don T Know If The Salt Cap Is Driving Away Residents Of High Tax States Tax Policy Center

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities

The Pass Through Entity Tax A Salt Limitation Workaround Marcum Llp Accountants And Advisors

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

A Fight Between The Biden Administration And Coastal Democrats Could Be Headed For The Supreme Court The New Republic

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran