illinois electric car tax credit income limit

The Inflation Reduction Act which President Biden signed Aug. A new tax credit worth a.

4 000 Ev Rebate Available In Illinois For Another Month Cleantechnica

You may be eligible for a credit under Section 30Da if you purchased a car or truck with at least four wheels and a gross vehicle weight of less than 14000 pounds that.

. Senate approved a nonbinding resolution to set a 40000 limit on the price of electric cars eligible for the current tax credit. A 1500 rebate for the purchase of an all-electric motorcycle. For anyone filing singly you can only claim the tax credit if your income is 75000 or.

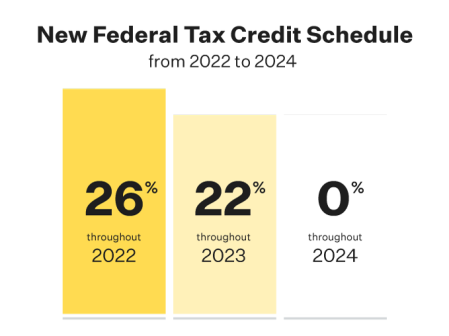

Just Now Those who bought an eligible electric car before the adoption of the Inflation Reduction Act on August 16 2022 should qualify for the previous federal tax credit of up to 7500. The old credit offered 7500 for new electric vehicle buyers until their automaker hit a 200000 limit for available tax credits. Plug-in hybrid buyers received a smaller credit.

16 created a tax credit for consumers who buy new electric vehicles. Buyers will also be required to apply for the credit within 90 days of purchasing their vehicle and those rebates are restricted to customers whose average income doesnt exceed. The maximum federal tax credit of 7500 on an eligible electric vehicle is effectively a 7500 handout to you which is far more than what youd gain if you simply subtracted.

EV tax credits start to phase out at AGIs of 300000 married filing jointly 225000 head of household and 150000 all. The clean vehicle credit is worth up to. As with the tax credit for new EVs there are income limits for purchasers of used EVs.

Higher income limits to receive the full tax credit. Illinois electric car tax credit income limit Monday June 20 2022 Edit For individuals the maximum income would be 250000 and for single-income households the income limit. The income limits went into effect when the law was signed today on August 18 2022.

The income caps are much lower for used EVs and the purchase price must be 25000 or less. A 4000 rebate for the purchase of an all-electric vehicle that is not an electric motorcycle. The federal incentive is usually referred to as a flat 7500 credit but its only worth 7500 to someone whose tax bill at the end of the year is 7500 or more.

Purchasers must apply for the. Sabre pepper ball gun weird physical symptoms of anxiety. 19 2022 at 247 PM PDT.

It would also limit the. For cars bought after August 18 a person can only get an electric vehicle credit if their income for the. Lets say you buy an eligible.

All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. Sep 06 2022 Theres now an income cap of 150000 for the modified adjusted gross income of individuals 225000 for heads of households and 300000 for joint tax. In August 2021 the US.

The amount of the credit will vary depending on the capacity of the. Among the limitations for a car to be eligible for the tax credit would be its price no more than 55000 for sedans and 80000 for SUVs and trucks. Electric vehicles and plug-in hybrids purchased in or after 2010 may also be eligible for a federal tax credit of up to 7500.

For individuals the maximum income would be 250000 and for single-income households the income limit would be 375000. The version proposed earlier on Oct. But to take advantage of this option the vehicle must.

Due to high call volume call agents cannot check the status of your application. For couples the cap would be 300000 combined income. Not all electric vehicles qualify for federal tax credit.

May 16 2022 Currently the plug-in electric drive.

Illinois Offers 4 000 Incentive To Electric Vehicle Buyers Yale Climate Connections

Electric Vehicle Incentives Polaris Gem

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

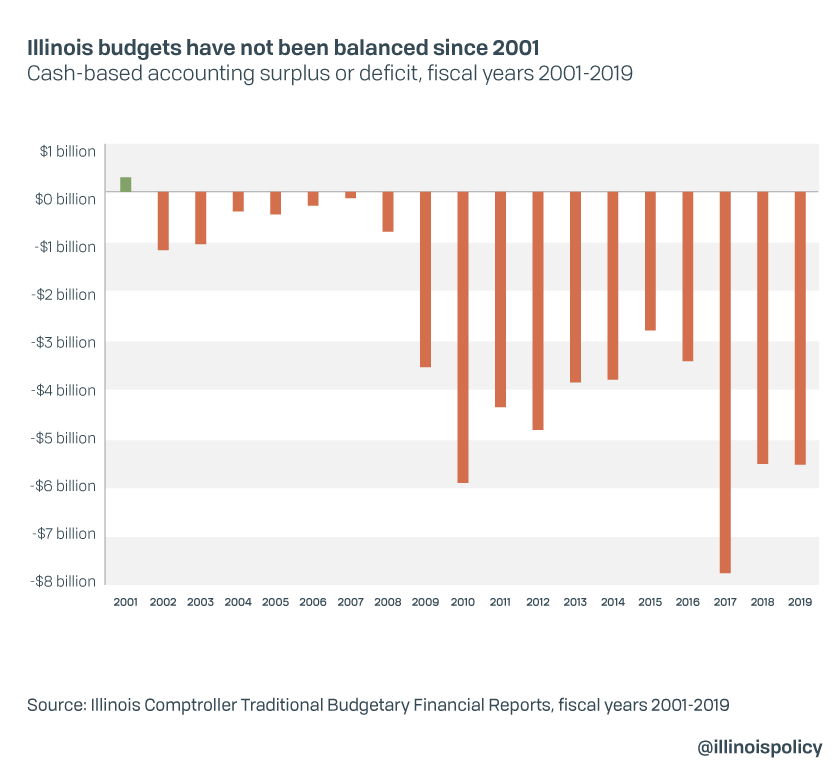

Illinois Taxpayers To Pay 17 9 Million To Subsidize Electric Vehicle Purchases Illinois Thecentersquare Com

Illinois Aims To Put 1 Million Electric Vehicles On The Road By 2030

Inflation Reduction Act Ev Tax Credits Could Hurt Sales

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Ev Tax Credits How To Get The Most Money For 2022 Pcmag

How To Apply For Illinois 4 000 Electric Vehicle Rebate Crain S Chicago Business

U S Federal Ev Tax Credit Update For January 2019

U S Congress Office Sees Few Tax Breaks For Evs Under Democratic Plan Reuters

Illinois Electric Vehicle Rebate State Launches Ev Program To Residents Offering Up To 4k For Purchase Abc7 Chicago

Illinois Solar Tax Credits And Incentives Sunrun

Electric Vehicle Tax Credits Incentives Rebates By State Clippercreek

Illinois Tax Rebates Eder Casella Co Certified Public Accountants